Today’s silver market opened with significant moves after days of large price swings. In India, metal prices remain sensitive to global direction, while international benchmarks also saw volatile trading. Investors and traders continue to weigh safe-haven demand, profit-taking and macroeconomic trends before placing big trades.

Globally, silver prices have struggled to find stable footing after a strong rally earlier this year. Following dramatic ups and downs, markets saw renewed activity as traders responded to economic data and currency fluctuations. This volatility reflects shifting risk appetite among participants and mixed signals from major economies.

In Indian domestic markets, silver prices have trended lower compared to recent peaks, even as some short-term rebounds occurred. Traders say local demand from industrial users and investors has slowed slightly as buyers watch how global trends evolve. The broader precious metals complex — including gold — also remains in a cautious phase as markets digest recent trends in equities and currencies.

SILVER PRICE – 03 FEB 2026

Data based on silver market summaries

Note: Prices can vary slightly by city and by dealer. The table above shows general national average figures for major centres

Market Trend & What’s Driving Prices

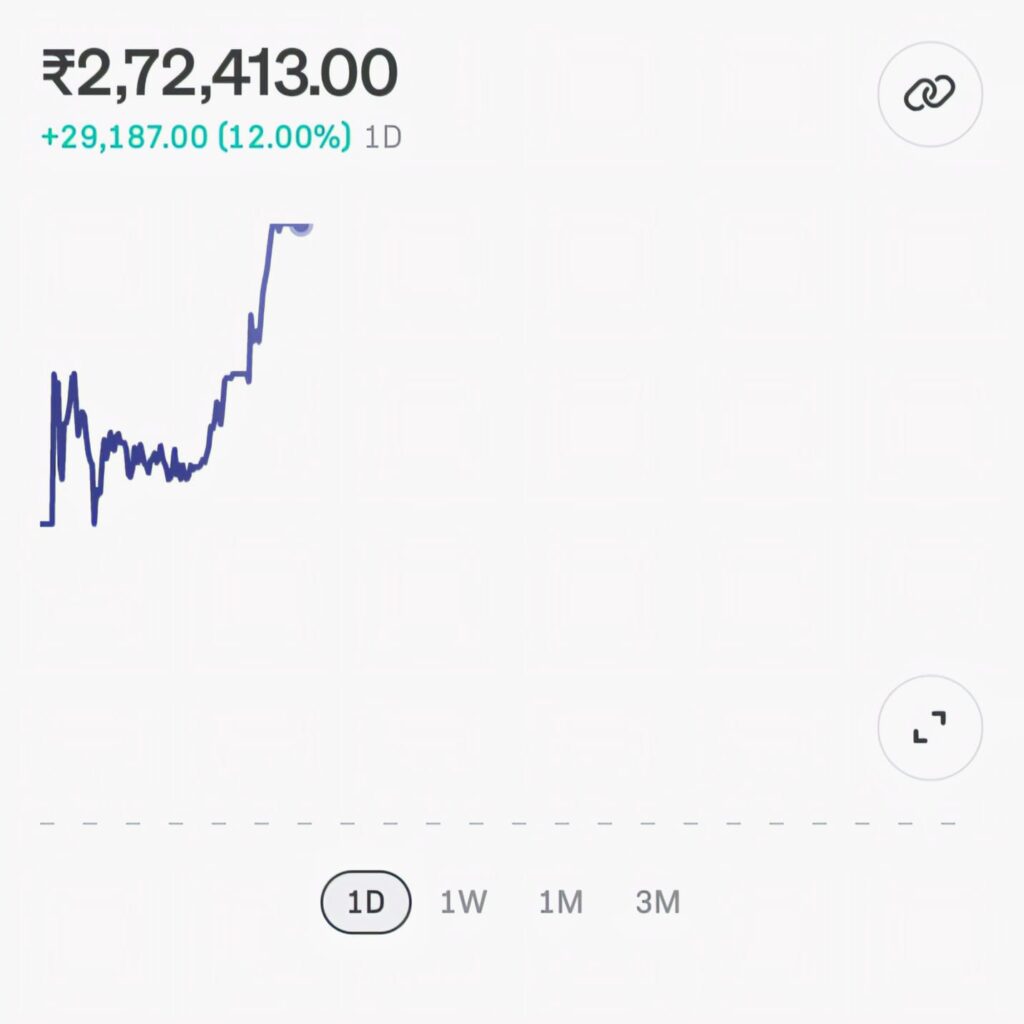

1. Recent Price Movement:

Silver prices in India have eased from recent peaks seen in late January. Traders report that profit-taking and less aggressive buying pressure have pulled prices down from levels above ₹350 per gram.

2. Global Influence:

International silver markets have also been choppy, swinging with broader commodities and dollar demand. When the US dollar gains strength, precious metals — priced in dollars — often face downward pressure.

3. Volatility & Speculation:

After massive rallies earlier, silver is seeing quick directional changes as speculative traders adjust positions. This has contributed to some of the sharp moves seen this week.

📌 What Investors Should Watch

- 📊 Currency Movements: A stronger rupee usually lowers domestic silver prices; a weaker rupee can push them higher.

- 🌍 Global Economic Data: Reports on inflation, interest rates and industrial demand can influence silver futures worldwide.

- 📉 Market Sentiment: Volatility remains high — many short-term traders are watching technical levels for breakout or breakdown signals.

📝 Conclusion

Silver prices today reflect a market in flux. After dramatic moves in recent weeks, the metal is now trading at more moderate levels in India. While long-term demand fundamentals — such as industrial use and safe-haven appeal — remain intact, short-term price swings are likely to continue as global markets digest economic signals and investor sentiment shifts.